child tax credit december 2019 payment date

The federal body said the advance monthly payments will begin on July 15 and payments will be issued every month after then through December 2021. That drops to 3000 for each child ages six through 17.

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

The IRS is paying 3600 total per child to parents of children up to five years of age.

. 15 opt out by Aug. Canada child benefit payment dates The CRA makes Canada child benefit CCB payments on the following dates. File a federal return to claim your child tax credit.

The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. For most families the agency relies on bank account information provided through. Payment dates for the child tax credit payment The next and last payment goes out on Dec.

Those payments will last through December. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have. You choose if you want to get paid weekly or every 4 weeks on your.

The eligible individuals 2019 tax return including information entered into the Non-Filer tool on IRSgov in 2020. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The couple would then receive the 3300.

21 rows Find out when your tax credits payment is and how much youll get paid. Payment Month Payment Date. Many taxpayers received their.

15 by direct deposit and through the mail. Tax credit payments are made every week or every 4 weeks. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum 750.

Decembers child tax credit is scheduled to hit bank accounts on Dec. Simple or complex always free. Americans who qualify for child tax credit will be.

If an eligible individual. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. 15 opt out by Oct.

2022 You will not receive a monthly payment if your total benefit amount for the year is less than 240. Eligible parents get 300 for each child who is aged under six and 250 for each child aged between 6 and 17 years old. Thats 300 per month 3600 12 for the younger child and 250 per month 3000 12 for the older child.

29 What happens with the child tax credit payments after December. Your Child Benefit payment is usually paid early if its due on a bank holiday. Instead you will receive one lump sum payment with your July payment.

13 opt out by Aug. The other half of the credit can be claimed as a lump sum on taxes in April. 15 and some will be for 1800.

15 opt out by Nov. Here are more details on the December payments. For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

Benefit payment dates - Canadaca Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20 2022 June 20 2022 July 20 2022 August 19 2022 September 20 2022 October 20 2022 November 18 2022 December 13 2022. 15 opt out by Nov. Go to My Account to see your next payment.

Most eligible families received payments dated July 15 August 13 September 15 October 15 November 15 and December 15. Advance Child Tax Credit payments were disbursed in monthly installments from July through December 2021.

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Pin On Taxation And Business Software

Money Dates 2019 Ativa Interactive Corp Dating Personals Dating How To Plan

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Missing A Child Tax Credit Payment Here S How To Track It Cnet

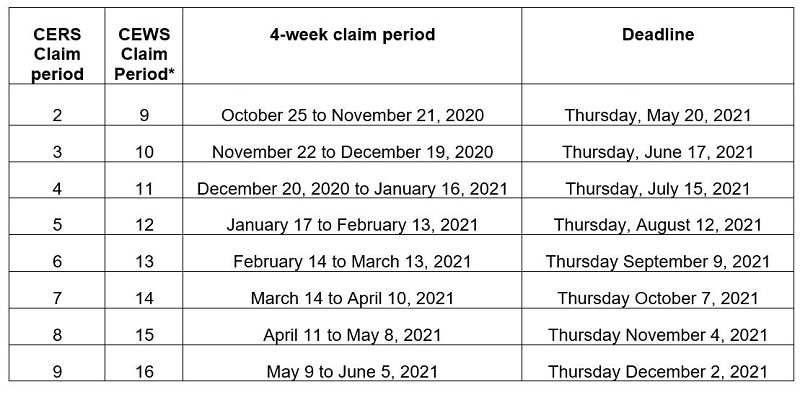

Canadian Tax News And Covid 19 Updates Archive

Canada Child Benefit Ccb Payment Dates Application 2022

Completed Sample Irs Form 709 Gift Tax Return For 529 Superfunding Front Loading

What Are Marriage Penalties And Bonuses Tax Policy Center

Canada Child Benefit Ccb Payment Dates Application 2022

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

Form 13 13a Instructions How To Get People To Like Form 13 13a Instructions Unbelievable Facts Tax Forms Irs

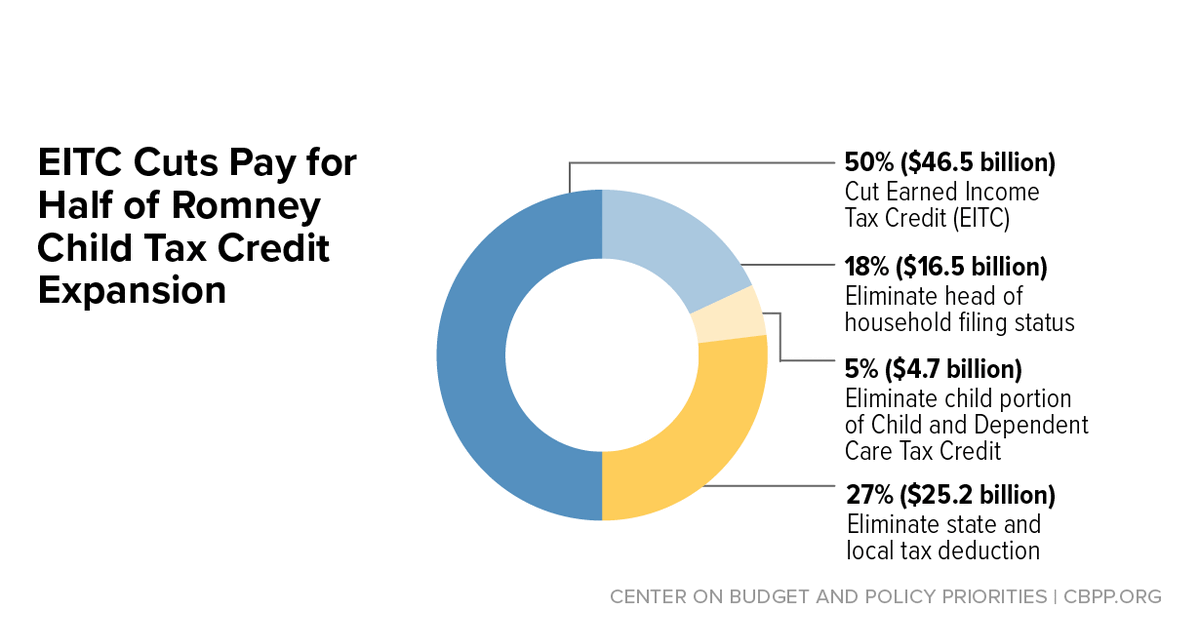

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities